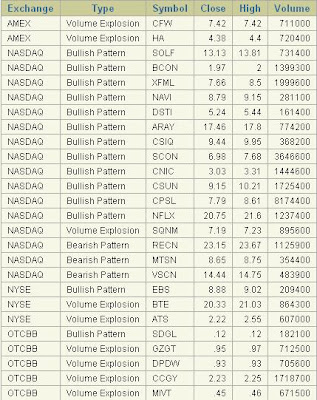

From today's list: SCON, CSIQ and RECN (Short)

Daily lists of potential short term big movers based on proven and successful technical patterns.

All posts are written strictly for informational purposes only and should not be viewed as advice to buy or sell or recommendation to invest, trade, and/or speculate in the markets. I am not an investment advisor, and the content of the site is not an endorsement to buy or sell any securities.

- Calculate the lowest close for a stock in last 260 days. If a stock has less than 260 days data calculate lowest close for those many days.

- Calculate percent change from lowest close and select stocks which had 100% plus growth

- Find the highest price in the 100% move and only take stocks which are within 25% of that highest price.

But there are subtle differences, which proves one did not copy from the other, they came up on their own. Which proves that this strategy is really good!I will talk about these blogs in more detail in later posts, and also a quick mention that there are other excellent investors/traders/bloggers out there, either I do not know them or have not followed them extensively to form any proper opinion, so please excuse my ignorance if you are not in the list above.

When I ask "people new to investing" to check these blogs, I do not mean experienced and successful traders/investors should not regularly visit these blogs, all of us can learn something from them. But when I was new to investing, I wish I had access to such great investing minds. I did the works - microcap, otcbb, value, growth, technical, fundamental and what not - without particularly knowing what I was doing and how to do it - only thing I knew is that I wanted to make some fast bucks :)

Talking of Apha Trends and technical analysis, sometime back I had more time in hand and also got a few hours during the day when I could watch the markets quite frequently. So, I tried my hand at technical analysis based trading - patterns and support-resistance and all that stuff, with decent success.

I had created a database where I would load nightly stock information (freely available data) and run some SQL queries to identify patterns like bull/bear flags, wedges, pennants and the likes. Now, I do not have time for those, but I plan to run my queries every night and post the potential candidates, so someone else might benefit from my excellent SQL query writing skills :)

So, you would ask what is my investment philosophy currently? Simple answer - EPS Growth based momentum investing. Simple, easy to identify. The difficult part is when to buy, when to sell and how to manage stops - that decides how much money you will actually make!

More later! Adios!